45l tax credit requirements

At the current time approved software on this list may only be used to verify compliance with the energy-efficiency requirements of the 45L tax credit for homes acquired on or before December 31 2021 the current expiration date of the 45L tax credit. Report on crossholdings of MREL among G -SIIs and O-SIIs.

MONTHLY SERVICE FEE.

. The Reserve Bank of India having considered it necessary in the public interest and being satisfied that for the purpose of enabling it to regulate the credit system to the advantage of the country it is necessary to give the directions as set out below in exercise of the powers conferred by sections 45K and 45L of the Reserve Bank of India. TDS 281 Challan is issued when a taxpayer deposits TDS and TCS for which they must comply with the. Impact assessment report on MREL.

This item Laptop Backpack 17 Inch Waterproof Extra Large TSA Travel Backpack Anti Theft College Business Mens Backpacks with USB Charging Port 173 Gaming Computer Backpack for Women Men Black 45L Laptop Backpack Travel Backpack Extra Large TSA 17 Inch Carry on Backpack Anti-Theft College School Student Backpack with USB PortLapsouno Water. While the Build Back Better Acts smorgasbord of tax incentives for clean energy new taxes on large corporations and wealthy individuals and tax relief for others remains stalled for now in the Senate 2022 nonetheless dawns with the advent of at least one new tax provision lapses of a number of others and at least a couple of sets of required regulatory rules. Government system that consolidated the capabilities of CCRFedReg ORCA and EPLS.

RTS on standardised and simplified methodologies for the IRRBB. We collaborate with taxpayers and their advisors to. Excise tax credits and outlay payments for alternative fuel.

SAMgov The System for Award Management SAM is the Official US. Guidance relating to manufactured homes will be provided in a separate notice. Fuel normalization credit discussion 55 min Part 3.

Total amount you pay to the bank excluding GST will be equal to the price of the item. The new energy efficient home credit determined under section 45La 24 the portion of the alternative motor vehicle credit to which. TDS Challan 281 Online Compliance.

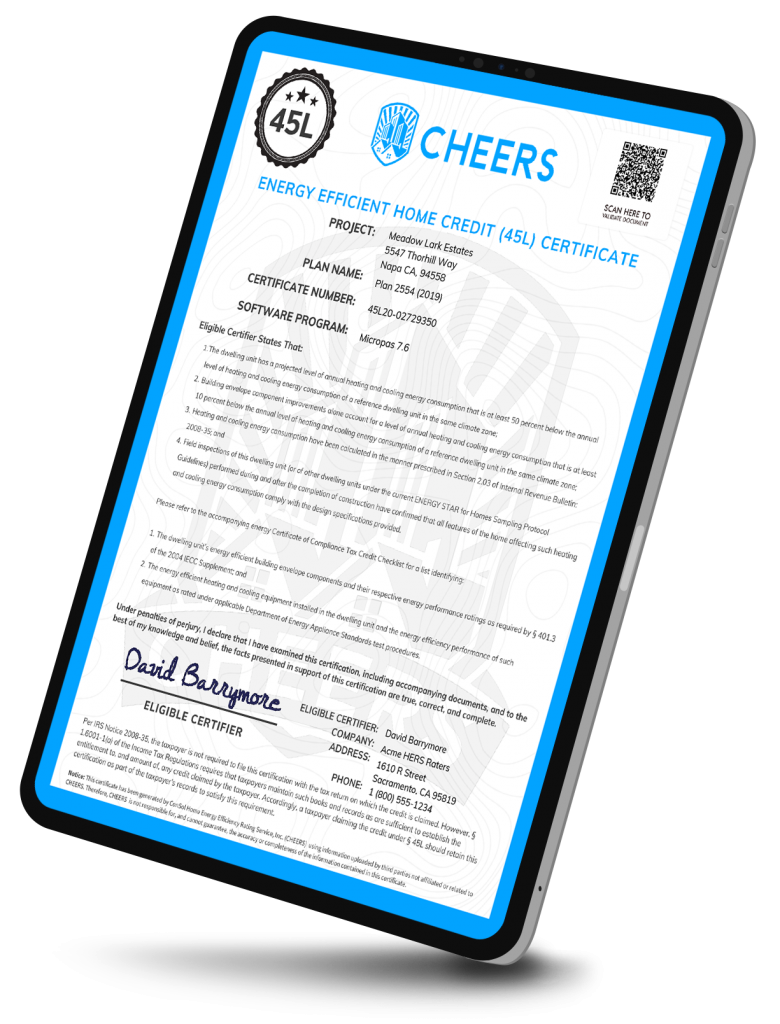

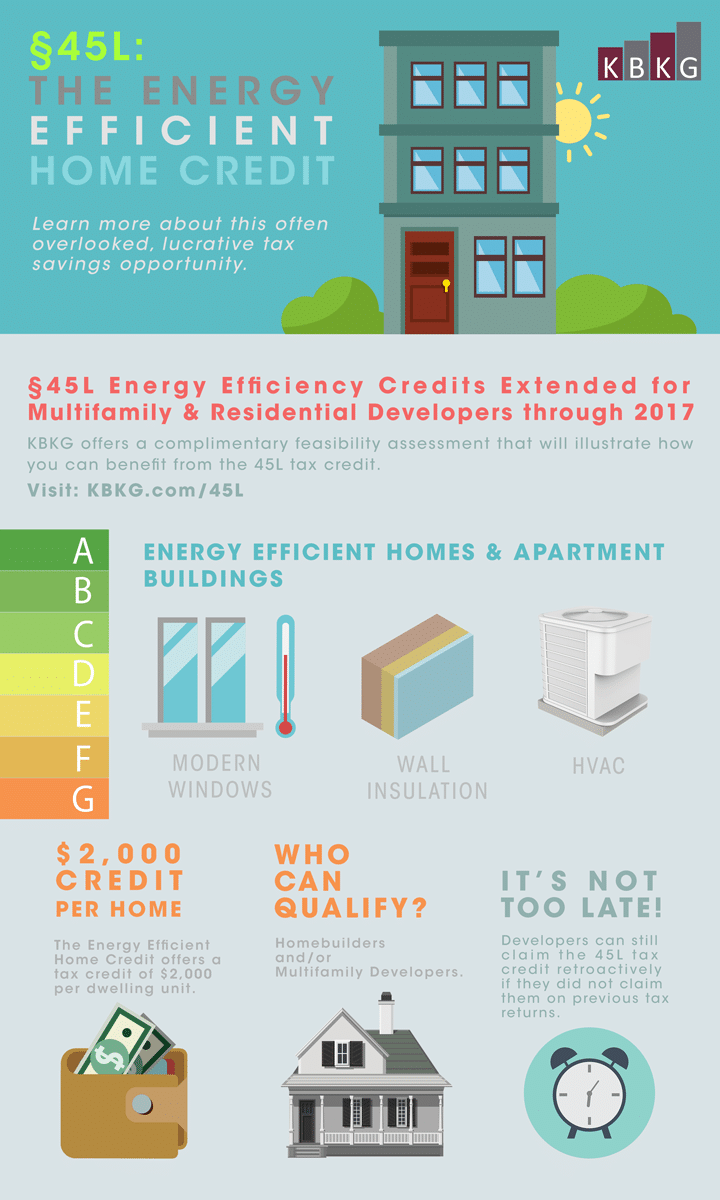

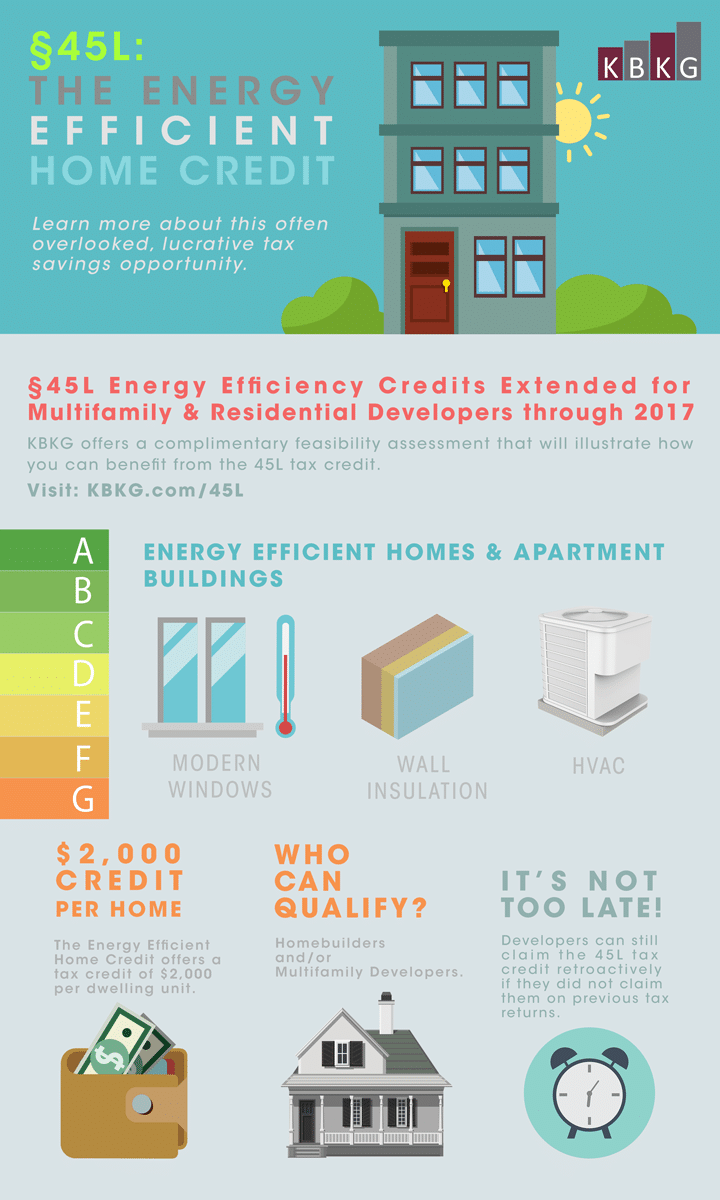

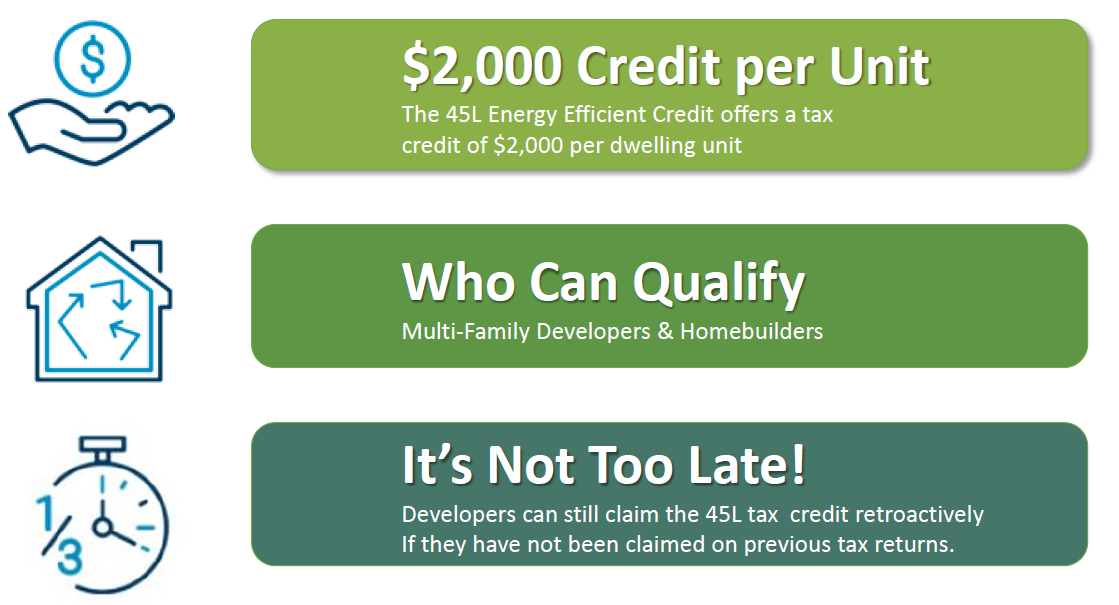

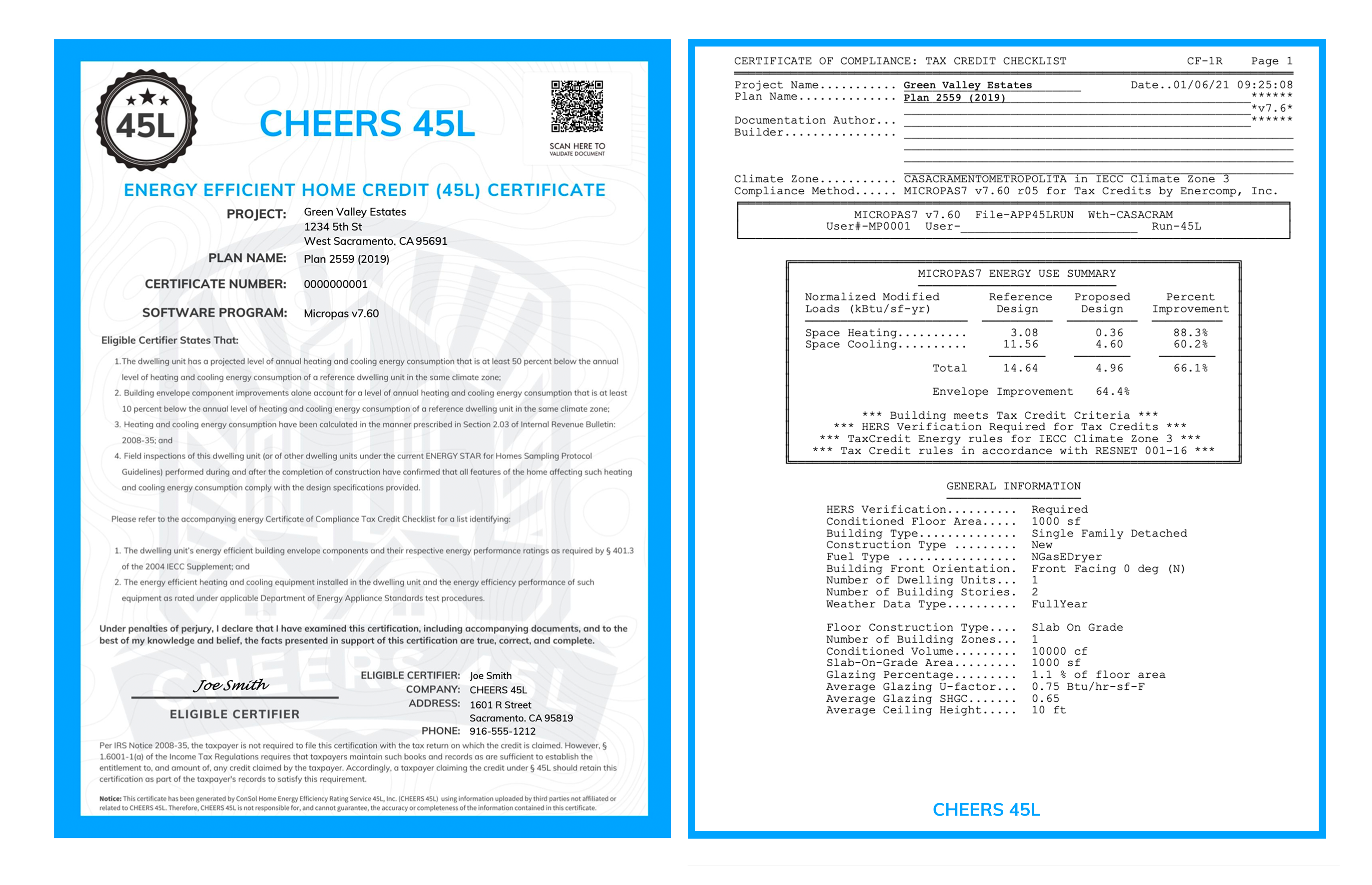

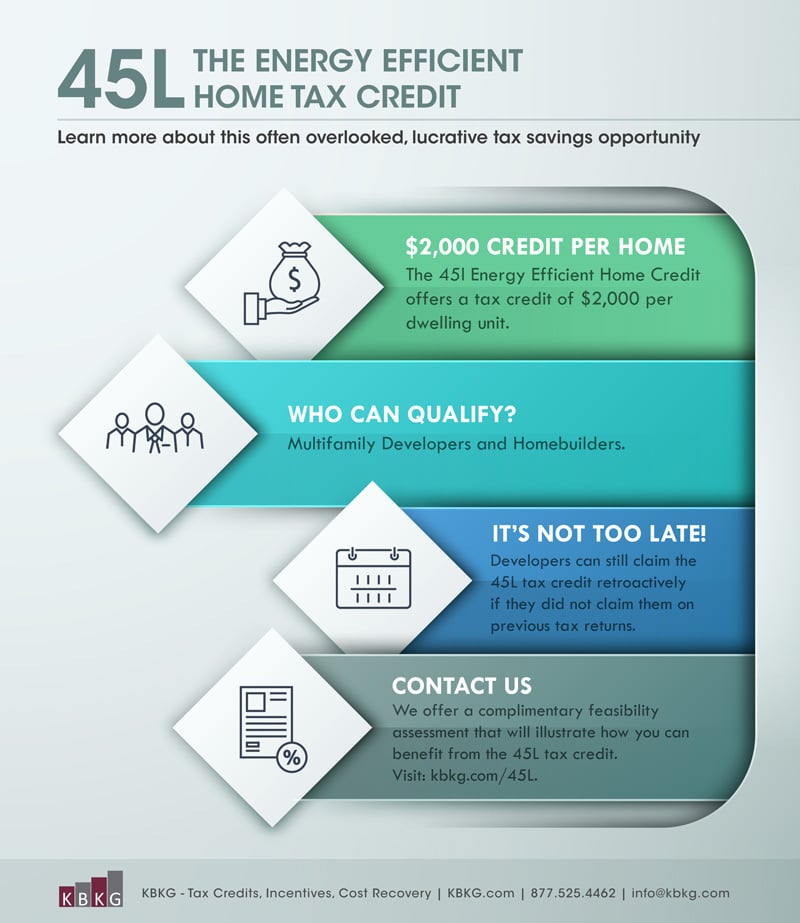

Energy Raters for Energy Star IRS 45L Tax Credits Jonathan Jones 16 min Recording compiled from previous webinars on May 14 and June 4 2021. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. A monthly service fee currently R39 will be charged to your account plus an additional R30 monthly service fee if you use both the Flexi and the Advantage accounts.

BACKGROUND 01 In General. Avail 3 Months No Cost EMI on select credit cards. The tax credit is available for homes builtmanufactured in the United States between January 1 2018 and December 31 2021.

Please check EMI plans in payments page for more details. 5 For the purposes of this Act the average rate of tax payable by a company for a year of tax shall be deemed to be an amount per kina being the amount ascertained by dividing the amount of income tax that would be assessed in respect of the taxable income derived by the company in the year of income if the company was not entitled to any. Namibia 165 of the credit price.

For qualified new energy efficient. However the child tax credit will not be allowed under the IRC to a territory resident if the mirror code tax systems allows a child tax credit against income taxes of the territory. Introduction to WSEC overview 14 min Part 2.

Guidelines on issue of Co-Branded Credit Cards. That Code section provides the tax credit for increasing research activities. Please note that with the exception of the tax credit for an ENERGY STAR certified manufactured home these tax credits are not directly linked to ENERGY STAR certification.

Article 45l2 of the BRRD. 2 which permitted an offset of regular investment tax credit against 25 percent of minimum tax. In exercise of the powers conferred by sections 45JA 45L and 45M of the Reserve Bank of India Act 1934 2 of 1934 and of all the powers enabling it in this behalf the Reserve Bank of India hereinafter also referred to as the Bank being satisfied that it is necessary and expedient in the public interest and being satisfied that for the.

Average of profits after tax as reduced by the preference dividend and adjusted. Articles 985a and 844 CRD V. Article 504a of the BRRD.

Purposes of obtaining a certification that satisfies the requirements of 45Ld. International tax is charged as follows. Asked questions FAQs in November to further aid taxpayers and passthrough entities in their reporting and filing requirements under the final regulations including worksheets for.

And struck out former par. Conferred under sections 45JA 45K 45L and 45M of the Reserve Bank of India Act 1934 Act 2 of 1934 and section 3 read with section 31A and section 6 of the. Energy credits discussion examples compliance tools 48 min.

DOE will update software requirements and the DOE Approved Software List in accordance with. 3 TDS Challan 282 is for depositing gift tax wealth tax transaction or security tax and similar other forms of indirect tax. For taxable years beginning after 12312020 a Puerto Rico bona fide resident may claim a fully refundable child tax credit by filing a return with the IRS.

Botswana 12 of the credit price. 2 TDS 281 Challan is specifically for Tax Deducted at Source TDS and Tax Collected at Source TCS. ICS Tax LLC is a nationwide consulting firm providing innovative tax planning strategies.

The area meets the size requirements under section 1392a. To avail the 3 months No Cost EMI offer on credit cards no interest amount will be charged on the price of your order.

What You Need To Claim The 45l Home Energy Efficient Tax Credit

Contractors Securing Work With The 45l Tax Credit Aeroseal

A Message For Earth Day Tax Credits That Work To Save The Environment

The 45l Tax Credit Is Expiring Again Cheers 45l

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

Next Up On 45l Federal Tax Credit Ducttesters Inc

Everything You Need To Know About 45l Tax Credit Mom And More

Section 45l Tax Credits The Most Overlooked Tax Credit For Residential Developers Krost

45l The Energy Efficient Home Credit Extended Through 2017

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

45l Tax Credit Services Using Doe Approved Software

45l Tax Credit Energy Efficient Tax Credit 45l

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas